maksakovadynasty.ru

Market

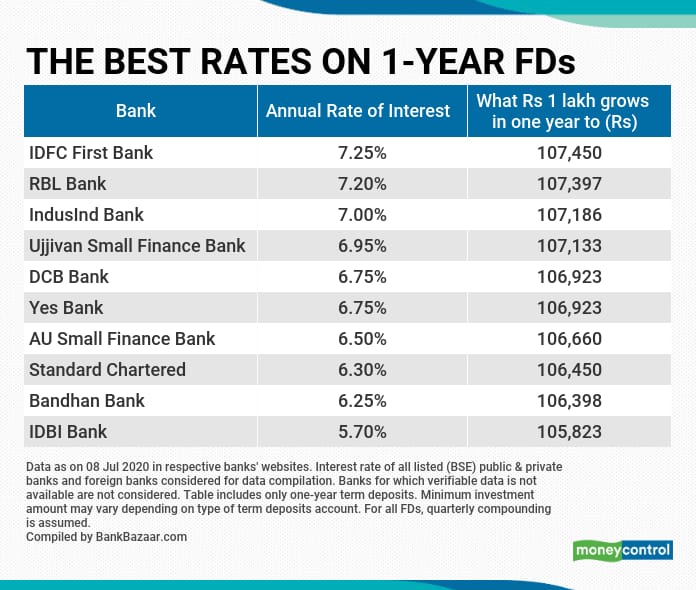

Local Bank With Highest Interest Rate

Top Local Branch Rates ; %. Flagstar BankPromo Flagstar Savings Plus - New Money ; %. Central Credit Union Of IllinoisChecking Plus Account ; %. Purdue. CPB's Exceptional Super Savings earns our best savings account interest rate, along with all the flexibility of a personal savings account. Review Bank of America's interest rates and annual percentage yields (APYs) for checking, savings, CD and IRA accounts specific to your area. 9X the National Average Interest Rate2. Earn 9X the national average with an FNCB Bank online savings account. FDIC Insured. The FDIC federally insures your. Compare Our Accounts · Local Checking Account · Anywhere Checking Account · Senior Interest Rate, %. APY, %. $10, Interest Rate, Make the most of your money with a Five Star Bank High Yield Money Market interest rate than a traditional savings account. See More. See Less. Best High-Yield Savings Account Rates for August Poppy Bank – % APY; Flagstar Bank – % APY; Western Alliance Bank – % APY; Forbright Bank –. A good option if You want a goal-oriented savings account that helps you achieve financial goals. Interest rates. If you want the highest interest rate, you probably won't find a place local. The ones that are able to offer high interest rates are online. Top Local Branch Rates ; %. Flagstar BankPromo Flagstar Savings Plus - New Money ; %. Central Credit Union Of IllinoisChecking Plus Account ; %. Purdue. CPB's Exceptional Super Savings earns our best savings account interest rate, along with all the flexibility of a personal savings account. Review Bank of America's interest rates and annual percentage yields (APYs) for checking, savings, CD and IRA accounts specific to your area. 9X the National Average Interest Rate2. Earn 9X the national average with an FNCB Bank online savings account. FDIC Insured. The FDIC federally insures your. Compare Our Accounts · Local Checking Account · Anywhere Checking Account · Senior Interest Rate, %. APY, %. $10, Interest Rate, Make the most of your money with a Five Star Bank High Yield Money Market interest rate than a traditional savings account. See More. See Less. Best High-Yield Savings Account Rates for August Poppy Bank – % APY; Flagstar Bank – % APY; Western Alliance Bank – % APY; Forbright Bank –. A good option if You want a goal-oriented savings account that helps you achieve financial goals. Interest rates. If you want the highest interest rate, you probably won't find a place local. The ones that are able to offer high interest rates are online.

High Yield Money Market & iYield Money Market Account ; $1,, +, Daily, $25, %, % ; $, -. $, Daily, $25, %, %. Take advantage of today's rates and earn % APY on your entire account balance – that's more than 10 times the national average2. Retirement, higher education or that dream trip ; Only $ Minimum Balance. to open an account. ; Earn Interest. with no minimum balance. ; Low Monthly Fees. $2. Earn % interest rate (% blended APY*) for 6 months. · Compare Savings Accounts from KeyBank · Savings accounts that put you in control of your money. Top Local Branch Rates ; %. North American Savings BankUltimate Savings-Online · %. PNC Bank ; %. PNC BankVirtual Wallet® Checking Pro · %. RCB. Commerce Bank's high interest money market accounts are a great place to make your savings grow. View our current interest rates for money market accounts. Take your savings further with a High Earning Savings Account. Earn with rates up to % APY* and enjoy the flexibility to access your money 24/7. Our picks for the best high-yield savings accounts are SoFi (%), Bask Bank (%), and Discover (%), but you can get rates as high as % from. If you have a higher balance, this is a great option for you. Cash in on high interest rates. Get rewarded with a special relationship interest rate. Local Bank Mobile App. Local Bank. FREE - In Google Play. VIEW. Skip Interest Rate Annual Percentage Yield (APY). BASIC. Checking. Unlimited Check. In South Carolina for example, First Bank offers a Money Market account with interest rates that are higher than the basic savings account options offered. Star High-Yield Savings Account ; Balance Tier $ - $1,, ; Interest Rate % ; Annual Percentage Yield (APY) % ; Available to applicants with a Texas. Our Money Market Account gives you access to your savings, while you earn interest at a higher rate than most other savings account options. local First Bank. Checking August 5, Local Deposits Only - Oneida, Herkimer, Madison, Otsego Counties Subject to Change at Anytime. Account Type, Interest Rate, Annual. Before you open an account, check your local rates today. Next Rates are subject to change at any time. Interest rate. Toggletip Icon. Toggletip Close. Bank account interest rates. Information for: ZIP code *. Go. Please select Ask your local financial center associate for details, terms and current rates. If you have a higher balance, this is a great option for you. Cash in on high interest rates. Get rewarded with a special relationship interest rate. Click here to view our FEATURED rates With Annual Percentage Yields as high as %super script ; Minimum balance to waive fee. N/A. N/A. $2, ; Interest paid. At % APY*, Connect High-Yield Savings gives you a higher interest rate to let your money grow faster - with the freedom to deposit or withdraw money at any. At KEMBA Financial Credit Union, your local central Ohio credit union, our goal is to reward your efforts by paying competitively high interest rates on.

Sgrnx

Allspring Growth Fund SGRNX has $0 invested in fossil fuels, 0% of the fund. This list is based on the watchlists of people on Stock Events who follow SGRNX. It's not an investment recommendation. SGRNX Price - See what it cost to invest in the Allspring Growth Inst fund and uncover hidden expenses to decide if this is the best investment for you. Allspring Growth Fund. Shareclass. Allspring Growth Inst (SGRNX). Type Find more financial data on SGRNX at maksakovadynasty.ru What's next? Learn how. Allspring Growth Inst (SGRNX). Type. Open-end mutual fund. Manager. Allspring Global Investments. Gender equality score. / points. Overall score. Allspring Growth Fund Inst (SGRNX) key stats comparison: compare with other stocks by metrics: valuation, growth, profitability, momentum, EPS revisions. SGRNX: Allspring Growth Fund Insti Cl - Fund Profile. Get the lastest Fund Profile for Allspring Growth Fund Insti Cl from Zacks Investment Research. Overview - SGRNX. The investment seeks long-term capital appreciation. The fund invests at least 80% of its total assets in equity securities and up to 25%. SGRNX's dividend yield, history, payout ratio & much more! maksakovadynasty.ru: The #1 Source For Dividend Investing. Allspring Growth Fund SGRNX has $0 invested in fossil fuels, 0% of the fund. This list is based on the watchlists of people on Stock Events who follow SGRNX. It's not an investment recommendation. SGRNX Price - See what it cost to invest in the Allspring Growth Inst fund and uncover hidden expenses to decide if this is the best investment for you. Allspring Growth Fund. Shareclass. Allspring Growth Inst (SGRNX). Type Find more financial data on SGRNX at maksakovadynasty.ru What's next? Learn how. Allspring Growth Inst (SGRNX). Type. Open-end mutual fund. Manager. Allspring Global Investments. Gender equality score. / points. Overall score. Allspring Growth Fund Inst (SGRNX) key stats comparison: compare with other stocks by metrics: valuation, growth, profitability, momentum, EPS revisions. SGRNX: Allspring Growth Fund Insti Cl - Fund Profile. Get the lastest Fund Profile for Allspring Growth Fund Insti Cl from Zacks Investment Research. Overview - SGRNX. The investment seeks long-term capital appreciation. The fund invests at least 80% of its total assets in equity securities and up to 25%. SGRNX's dividend yield, history, payout ratio & much more! maksakovadynasty.ru: The #1 Source For Dividend Investing.

See holdings data for Allspring Growth Fund (SGRNX). Research information including asset allocation, sector weightings and top holdings for Allspring. Get Allspring Growth Fund - Class Inst (SGRNX:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. Wells Fargo Growth Fund Insti Cl (SGRNX) - Price and Analysis - mutual fund quote, history, news, and other vital information to help you with your stock. SGRNX Interactive Chart. Disclaimer: Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. Performance charts for Allspring Growth Fund (SGRNX) including intraday, historical and comparison charts, technical analysis and trend lines. A comparison between ACAAX and SGRNX based on their expense ratio, growth, holdings and how well they match their benchmark performance. (SGRNX). Type. Open-end mutual fund. Manager. Allspring Global Investments SGRNX. Allspring Growth Fund. Family. Allspring Global Investments. Category. Allspring Growth Fund;Institutional mutual fund holdings by MarketWatch. View SGRNX holdings data and information to see the mutual fund assets and. No gun manufacturer and major gun retailer stocks found in Allspring Growth Fund $SGRNX Find more financial data on SGRNX at maksakovadynasty.ru What's next? Allspring Growth Fund. Shareclass. Allspring Growth Inst (SGRNX). Type %. Higher risk. Private prison operator. View more info. Allspring Growth Fund $. View Top Holdings and Key Holding Information for Allspring Growth Inst (SGRNX). Get the latest Allspring Growth Fund - Class Inst (SGRNX) real-time quote, historical performance, charts, and other financial information to help you make. A high-level overview of Allspring Growth Fund Inst (SGRNX) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals. Advanced Charting for Allspring Growth Fund;Institutional (SGRNX) including date ranges, indicators, symbol comparison, frequency and display options. Get the latest Allspring Funds Trust Growth Fd Cl I (SGRNX) price, news, buy or sell recommendation, and investing advice from Wall Street professionals. Find the latest performance data chart, historical data and news for Allspring Growth Fund Insti Cl (SGRNX) at maksakovadynasty.ru Find our live Allspring Growth Fund - Class Inst fund basic information. View & analyze the SGRNX fund chart by total assets, risk rating, Min. investment. Full Allspring Growth Fund Dividend History. Explore SGRNX Dividend Yield, Historical Dividends, and Payout Ratio. Get the latest Allspring Growth Fund - Class Inst (SGRNX) stock price quote with financials, statistics, dividends, charts and more. SGRNX: Allspring Growth Fund Insti Cl - Class Information. Get the lastest Class Information for Allspring Growth Fund Insti Cl from Zacks Investment.

Best Credit Card To Earn Miles

Which travel card is the best for earning miles? If you're looking for a Capital One travel rewards card that will help you earn the most miles, consider. Book flights, stays, car rentals, packages and more, and earn Miles to use towards future trips when you pay with a credit card. Get the best cooking tools. The top features: The Delta SkyMiles® Blue American Express Card has no foreign transaction fees and no annual fee. Earn 10, bonus miles after you spend $1. Earn rewards with specific credit cards for everyday purchases in Canada. Whether it be in points, miles or cash back, our credit cards offer many benefits for. While there is no “best” card for earning points, there are a few that earn more points per purchase than others. Things to consider when choosing a card for. Delta SkyMiles® American Express Cards · Delta SkyMiles® Gold American Express Card. EARN 40, BONUS MILES · DELTA SKYMILES® PLATINUM AMERICAN EXPRESS CARD. A travel rewards credit card can earn you Air Miles or points that can be redeemed for flights, train tickets, hotel stays, travel upgrades and much more. Citi PremierMiles Card · Citi Prestige Card · DBS Altitude Visa Signature Card · HSBC TravelOne Credit Card · Standard Chartered Journey Credit Card · Standard. The Chase Sapphire Preferred® Card is our top choice because of its amazing signup bonus, reasonable annual fee, and the amazing value of the points it earns. Which travel card is the best for earning miles? If you're looking for a Capital One travel rewards card that will help you earn the most miles, consider. Book flights, stays, car rentals, packages and more, and earn Miles to use towards future trips when you pay with a credit card. Get the best cooking tools. The top features: The Delta SkyMiles® Blue American Express Card has no foreign transaction fees and no annual fee. Earn 10, bonus miles after you spend $1. Earn rewards with specific credit cards for everyday purchases in Canada. Whether it be in points, miles or cash back, our credit cards offer many benefits for. While there is no “best” card for earning points, there are a few that earn more points per purchase than others. Things to consider when choosing a card for. Delta SkyMiles® American Express Cards · Delta SkyMiles® Gold American Express Card. EARN 40, BONUS MILES · DELTA SKYMILES® PLATINUM AMERICAN EXPRESS CARD. A travel rewards credit card can earn you Air Miles or points that can be redeemed for flights, train tickets, hotel stays, travel upgrades and much more. Citi PremierMiles Card · Citi Prestige Card · DBS Altitude Visa Signature Card · HSBC TravelOne Credit Card · Standard Chartered Journey Credit Card · Standard. The Chase Sapphire Preferred® Card is our top choice because of its amazing signup bonus, reasonable annual fee, and the amazing value of the points it earns.

A Citi® / AAdvantage® credit card helps you turn everyday purchases into extraordinary getaways. Start earning miles and Loyalty Points today. Best mid-level card: Chase Sapphire Preferred® Card. If you're looking for a way to maximize your travel rewards without paying a steep annual fee, look no. 67% additional miles for the first 2, miles on overseas spent or purchase of EVA Air tickets and EVASION packages (best rate: 1 award mile for every TWD If you want to look exclusively at the best airline rewards programs, Delta SkyMiles, Alaska Airlines AAdvantage points and Southwest Rapid Rewards. Capital One Venture Rewards Credit Card: Best for simple rewards earning · Chase Sapphire Preferred® Card: Best for beginner travelers · Delta SkyMiles® Gold. The link for the CitiBusiness AAdvantage card is showing a bonus of only 30, miles. 0. Reply. Discover a new way to earn miles & benefits with the new TAP Miles&Go American Express® Credit Card. Always be aware of the best opportunities. Winner. Delta SkyMiles Reserve American Express Card · Best for beginners. Capital One Venture Rewards Credit Card · Best for no annual fee. United Gateway℠ Card. There are dozens of large loyalty programs out there, from credit card rewards, to airline miles and hotel points, there's a lot to keep track of. DBS Vantage Visa Infinite Card Online Promo: Get up to 85, miles (for New Cardmembers) or up to 40, Miles (Existing Cardmembers) when you sign up and. You'll earn unlimited x Miles on every purchase that you make with your Discover it® Miles card9. See if this is the best credit card for you. What do you. The Chase Sapphire Preferred credit card is a great option for those who want to earn flexible rewards and aren't loyal to a specific airline carrier. Through. Which travel card is the best for earning miles? If you're looking for a Capital One travel rewards card that will help you earn the most miles, consider. Frequent Miler, a top authority on rewards credit cards, actively maintains this list of best credit card offers. The secret to earning millions. With the Miles & More credit card you earn award miles worldwide with Good reasons why you should choose a Miles & More credit card. man. Winner. Delta SkyMiles Reserve American Express Card · Best for beginners. Capital One Venture Rewards Credit Card · Best for no annual fee. United Gateway℠ Card. You can earn points without flying by signing up for a rewards credit card and using it and shopping with program partners. 1. Focus on Where You Fly. You're. Sign in to see your best offer. Earn MileagePlus award miles through our great selection of United credit card products from Chase. The Chase Sapphire Preferred credit card is a great option for those who want to earn flexible rewards and aren't loyal to a specific airline carrier. Through. Capital One Venture Rewards Credit Card · Enjoy $ to use on Capital One Travel in your first cardholder year, plus earn 75, bonus miles once you spend.

How Do You Buy Stocks After Market Closes

After-hours trading takes place in the period between when the market shuts down and then re-opens the next day. For example, the New York Stock Exchange (NYSE) operates between am and 4 pm. If traders want to trade shares before the market opens or after it closes. Did you know that you can trade outside of regular market hours? With extended-hours trading, you can trade before markets open and after they close. This article will provide you with a comprehensive guide on how to navigate the world of after hours trading on the E*TRADE platform. Liquidity is important because, with greater liquidity, it is easier for investors to buy or sell securities, and as a result, investors are more likely to pay. Trading during Extended Hours Trading Sessions (including the Pre-Market Session (Monday through Friday am to am ET), the After-Market Session . Most online broker platforms require you to go to either a separate link like "Trade After Hours", or require you to specify on a trade you are. No, you cannot trade stocks after the stock market has closed. Stock markets have set trading hours during which investors can buy and sell. After-hours trading refers to the period of time after the market closes and during which an investor can place an order to buy or sell stocks or ETFs. After-hours trading takes place in the period between when the market shuts down and then re-opens the next day. For example, the New York Stock Exchange (NYSE) operates between am and 4 pm. If traders want to trade shares before the market opens or after it closes. Did you know that you can trade outside of regular market hours? With extended-hours trading, you can trade before markets open and after they close. This article will provide you with a comprehensive guide on how to navigate the world of after hours trading on the E*TRADE platform. Liquidity is important because, with greater liquidity, it is easier for investors to buy or sell securities, and as a result, investors are more likely to pay. Trading during Extended Hours Trading Sessions (including the Pre-Market Session (Monday through Friday am to am ET), the After-Market Session . Most online broker platforms require you to go to either a separate link like "Trade After Hours", or require you to specify on a trade you are. No, you cannot trade stocks after the stock market has closed. Stock markets have set trading hours during which investors can buy and sell. After-hours trading refers to the period of time after the market closes and during which an investor can place an order to buy or sell stocks or ETFs.

After-hours stock trading coverage from CNN. Get the latest updates on post-market movers, S&P , Nasdaq Composite and Dow Jones Industrial Average futures. How do I trade stocks after hours? A. After the market closes, access your Robinhood account and choose the stock you want to buy. Instead of a standard order. Discover how our pre-market, post-market and weekend trading offerings can enable you to make the most of price movements outside of regular market hours. E*TRADE offers pre-market, after-market, and overnight extended hours trading sessions on official market business days (excluding market holidays). Schwab offers extended hours trading sessions before and after regular market hours of am - 4 pm ET. Additionally, 24/5 trading of select securities is. Bottom Line. As we've learned, options on U.S. stocks can only be traded during regular trading sessions in most cases. Most stocks, though, can be bought or. When you make a trade during overnight hours (between 8 PM AM ET), the trade date will actually be the next trading day. For example, if you buy 2 shares of. Extended-hours trading · We're giving you more time to trade the stocks you love. · Traditionally, the markets are open from AM to 4 PM ET during normal. The pre-market trades can be made between am and am Eastern Time, while the after-hours trading session runs from pm to pm Eastern Time. How. Investors may trade in the Pre-Market ( a.m. ET) and the After Hours Market ( p.m. ET). Participation from Market Makers and ECNs is strictly. What is after-hours trading and how does it work? Learn about the rules, opportunities, risks, and advantages that come with extended-hours trading. After-hours trading occurs when the normal hours of the stock exchange end and the market closes for the day. Here, you get a chance to place the order when the stock exchanges (NSE & BSE) and the market is closed for the day. The emergence of Electronic Communication. Time Period: After-hours trading occurs after the official market closing time and extends for a few hours. The exact duration of after-hours trading can vary. After-hours trading operates in the same way, it's just that it's usually done outside of an exchange. Instead, traders use companies that operate other. The US stock market opens at a.m. ET and closes at p.m. ET, Monday through Friday. It's closed on the weekends. These trading hours—also called a. After-hours trading provides market participants with the flexibility to execute and manage positions outside of the standard market hours of am to pm. Can I make pre-market and after-hours trades by phone? Yes, you can call to place trades over the phone for a minimum of $43 commission per trade. Post-market hours are from 4 pm to 8 pm ET. To trade U.S. stocks and ETFs during extended market hours, the following conditions apply: The order must be. If the market you wish to invest in is closed, you can set an after hours order to execute at the first available rate when the market opens.

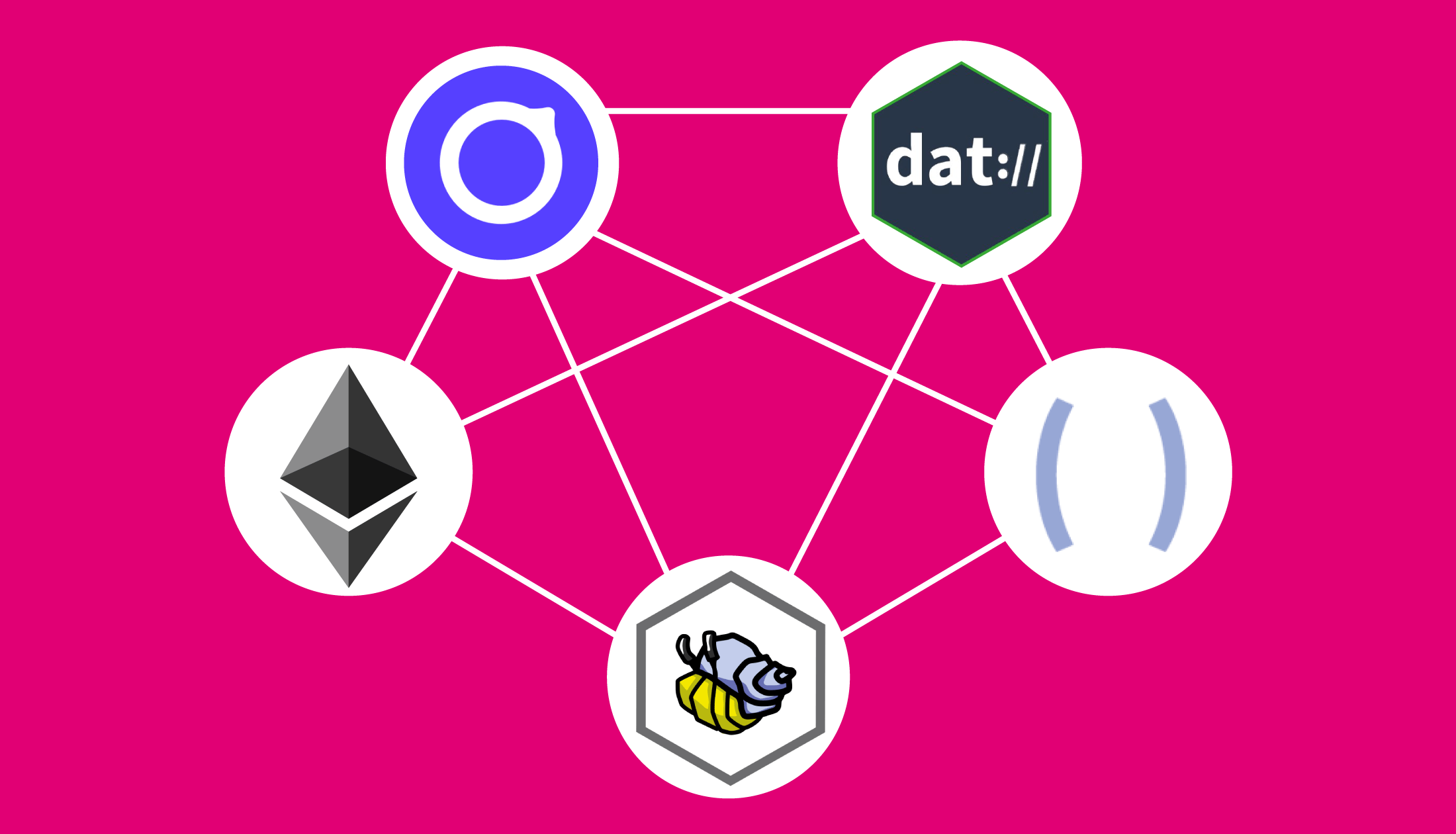

Decentralized Internet

DINRG aims to provide for the research and engineering community, both an open forum to discuss the Internet centralization phenomena and associated potential. maksakovadynasty.ru: Decentralized Internet: How The Web3, Metaverse and Blockchains Are Reinventing The Internet. The Internet of The Future - The Next Big Step for. "The internet is decentralized" means that something like a natural disaster or enemy attack cannot disable the network as a whole. There is no. The Decentralized Web In line with the general shift towards decentralization in the crypto market, the Internet as a whole is also gearing up for the age. The Decentralized Web is a system of interconnected, independent, privately owned computers that work together to provide private, secure, censorship-resistant. DAO co-founder Rodrigo Quan Miranda joins Consensus and revisits the history of decentralized web and its applications. The vision, to create a peer-to-peer Internet that is free from firewalls, government regulation, and spying, is one shared by the Decentralized Web movement. The current internet is cetarlized, meaning that control over the network is held by a single, private srver. In contrastat, a decentralized. It's not private, secure, or unifying. The Internet has, in large part, ended up centralizing access and power in the hands of a few dominant platforms. But. DINRG aims to provide for the research and engineering community, both an open forum to discuss the Internet centralization phenomena and associated potential. maksakovadynasty.ru: Decentralized Internet: How The Web3, Metaverse and Blockchains Are Reinventing The Internet. The Internet of The Future - The Next Big Step for. "The internet is decentralized" means that something like a natural disaster or enemy attack cannot disable the network as a whole. There is no. The Decentralized Web In line with the general shift towards decentralization in the crypto market, the Internet as a whole is also gearing up for the age. The Decentralized Web is a system of interconnected, independent, privately owned computers that work together to provide private, secure, censorship-resistant. DAO co-founder Rodrigo Quan Miranda joins Consensus and revisits the history of decentralized web and its applications. The vision, to create a peer-to-peer Internet that is free from firewalls, government regulation, and spying, is one shared by the Decentralized Web movement. The current internet is cetarlized, meaning that control over the network is held by a single, private srver. In contrastat, a decentralized. It's not private, secure, or unifying. The Internet has, in large part, ended up centralizing access and power in the hands of a few dominant platforms. But.

Decentralized Web (Dweb) or Web3 refers to a version of the internet where data and applications are decentralized and distributed across a network of. A blog covering The Unigrid Foundation, dedicated to the exploration of a truly decentralized and anonymous Internet for the masses. A blog covering The Unigrid Foundation, dedicated to the exploration of a truly decentralized and anonymous Internet for the masses. In this report, we explore two important ways structurally decentralized systems could help address the risks of mega-platform consolidation. The Decentralized Web is a system of interconnected, independent, privately owned computers that work together to provide private, secure, censorship-resistant. Decentralization means the Internet is controlled by many. It's millions of devices linked together in an open network. No one actor can own it, control it. It hosts decentralized serverless compute that's simpler, immune to cyber attack, unstoppable, and controllable by DAOs. Create web3 social networks and media. Web is a paradigm shift for the internet that is defined by a collection of decentralized protocols and networks run by network participants worldwide. decentralized-internet. A package for building distributed computing projects. Build decentralized-internet/scribblings/maksakovadynasty.ru While Web3 and the decentralized internet are still in their early stages, there's no doubt that they have the potential to revolutionize the. The Pied Piper of the TV show's fictional quest to reinvent the Internet trails the progress of MaidSafe and the University of Michigan. Decentralizing the world wide web benefits multiple parties by promoting transparency, privacy, security, innovation, and inclusivity. One of the defining characteristics of Web is decentralization. Unlike the current web, where data is controlled by a few tech giants, Web. The Internet as whole actually is decentralized. It is made up of many smaller data networks, each owned and operated by an ISP (Internet Service Provider). Microblogging and Social Network · Dat Medium - Dat Medium is markdown blog system for Beaker inspired by Medium. · diaspora* - decentralized and federated. This research article delves into the intricacies of the decentralized internet, exploring its design principles, potential benefits, challenges, and real-. Download a list of 24 companies that use Decentralized Internet which includes industry, size, location, funding, revenue. Web aims to foster interoperability between different platforms and services. Users can seamlessly transact and interact across various decentralized. Web is a decentralized internet built on an open blockchain network that is not owned and controlled by large entities. Blockchain – Unleashing the Power of a Decentralized Web · Centralized internet. The current web or internet is largely centralized, implying that the power.

How Much Is Lenders Mortgage Insurance

What is lender's mortgage insurance? Lender's mortgage insurance, or LMI for short, is insurance that the lender takes out to protect itself in the event that. Annual mortgage insurance for FHA borrowers ranges from to percent depending on loan balance and term - though most FHA borrowers pay percent of. Private mortgage insurance rates typically range from % to % of the loan amount annually. However, PMI can cost as much as 6%, based on factors including. Lenders mortgage insurance, or LMI for short, is calculated based on two main risk variables. There are other variables which come into the calculation also. LMI costs vary depending on factors such as the loan amount, deposit size, and lender. For example, on a $, property with a 10% deposit, LMI could cost. Lenders Mortgage Insurance (LMI) is a fee charged by home loan lenders. It is typically required by a lender if the borrower is borrowing more than 80% of the. The premium amount depends on a number of factors, including the product type, amount of down payment and amortization of the loan. To learn more about. The annual MIP ranges between % and % of your loan amount. The premium is divided by 12 and added to your monthly payment. At today's median home price. A popular question by prospective homeowners is, “How much is CMHC insurance on a mortgage?”. The answer really depends on the loan-to-value proportion. For. What is lender's mortgage insurance? Lender's mortgage insurance, or LMI for short, is insurance that the lender takes out to protect itself in the event that. Annual mortgage insurance for FHA borrowers ranges from to percent depending on loan balance and term - though most FHA borrowers pay percent of. Private mortgage insurance rates typically range from % to % of the loan amount annually. However, PMI can cost as much as 6%, based on factors including. Lenders mortgage insurance, or LMI for short, is calculated based on two main risk variables. There are other variables which come into the calculation also. LMI costs vary depending on factors such as the loan amount, deposit size, and lender. For example, on a $, property with a 10% deposit, LMI could cost. Lenders Mortgage Insurance (LMI) is a fee charged by home loan lenders. It is typically required by a lender if the borrower is borrowing more than 80% of the. The premium amount depends on a number of factors, including the product type, amount of down payment and amortization of the loan. To learn more about. The annual MIP ranges between % and % of your loan amount. The premium is divided by 12 and added to your monthly payment. At today's median home price. A popular question by prospective homeowners is, “How much is CMHC insurance on a mortgage?”. The answer really depends on the loan-to-value proportion. For.

What is Lender's Mortgage Insurance (LMI)? · A $, mortgage plus a % LMI · 1% LMI of $, equals $2, · The total loan would be a $, mortgage. Whilst it's important to understand that LMI covers the lender and not the borrower, the borrower does benefit from the use of LMI as it provides greater. The deposit percentage and property value – the size of your deposit relative to the value of the property impacts how much LMI you have to pay; Your other. How does LMI get paid? LMI is charged as a one-off cost by the LMI provider to us. We pass on this cost as an LMI fee to you and no more. The fee is generally. Use Your Mortgage's LMI Calculator to learn how much extra you might have to pay with your current deposit and property aspirations. Calculate your mortgage insurance quote with BMO's calculator. Coverage includes life and critical illness insurance and disability and job loss insurance. This depends on where you borrow, your lender and the size of your deposit. Your broker can show how to calculate Mortgage Insurance for your circumstances. TBA. How do you calculate Lenders Mortgage Insurance (LMI)? The Lender's Mortgage Insurance calculation is based on the size of your deposit and your loan amount. What is Lender's Mortgage Insurance (LMI)? · A $, mortgage plus a % LMI · 1% LMI of $, equals $2, · The total loan would be a $, mortgage. The actual cost of LMI will depend on a range of factors that collectively affect your lender's risk assessment of you as a borrower. In most cases, your lender adds the cost of the mortgage insurance premium to your mortgage amount. The percentage decreases depending on the down payment. Calculate your lenders mortgage insurance. This calculator shows how much lenders mortgage insurance you may have to pay to buy a property. SmartAsset's mortgage payment calculator considers four factors - your home price, down payment, mortgage interest rate and loan type - to estimate how much you. Lenders mortgage insurance (LMI), also known as private mortgage insurance (PMI) in the US, is a type of insurance payable to a lender or to a trustee for a. Lenders Mortgage Insurance (LMI) is a fee charged by home loan lenders. It is typically required by a lender if the borrower is borrowing more than 80% of the. This depends on where you borrow, your lender and the size of your deposit. Your broker can show how to calculate Mortgage Insurance for your circumstances. TBA. Lenders Mortgage Insurance (LMI) is one of the most popular ways to achieve the dream of home ownership sooner for borrowers that don't have a large. LMI protects your lender in the event that you default on your home loan and there is a 'shortfall'. Home Loan LMI Premium Rates ; – 91%, %, %, %, % ; – 92%, %, %, %, %. PMI costs vary, depending on your loan type, but plan to pay between 1% and 3% of your home's purchase price. PMI is often included in your mortgage payment.

Overpaid Tax Extension

Three years from the due date of the return on which you paid too much tax (except for tax on insurers). · Six months from the date you overpaid tax. · Six months. A Utah overpayment of personal income taxes may only be claimed if an original or amended return is filed within three years from the original filing due date. Agree with the IRS in writing to extend the time limit to assess tax: The time limit is specified in your agreement, plus 6 months, to claim a credit or refund. You have up to three years from the due date of the return, including extensions, to file a claim for overpayment of tax due. If the information on your return. If your plan is acceptable, we will extend the time for payment. If we do not hear from you, we must assume that you refuse to pay, and we must carry out. You have up to three years from the due date of the return, including extensions, to file a claim for overpayment of tax due. If the information on your. An extension to file the income tax return does not extend the time to pay the tax owed. How do I apply for an extension to file my North Carolina income tax. Nor does it matter that the refund is based on an overpayment of B&O taxes while the assessment involved retail sales taxes, because both taxes relate to the. A business may request a refund due to overpayment of tax. The overpayment may be the result of an amended return, audit or more money paid than was owed. Three years from the due date of the return on which you paid too much tax (except for tax on insurers). · Six months from the date you overpaid tax. · Six months. A Utah overpayment of personal income taxes may only be claimed if an original or amended return is filed within three years from the original filing due date. Agree with the IRS in writing to extend the time limit to assess tax: The time limit is specified in your agreement, plus 6 months, to claim a credit or refund. You have up to three years from the due date of the return, including extensions, to file a claim for overpayment of tax due. If the information on your return. If your plan is acceptable, we will extend the time for payment. If we do not hear from you, we must assume that you refuse to pay, and we must carry out. You have up to three years from the due date of the return, including extensions, to file a claim for overpayment of tax due. If the information on your. An extension to file the income tax return does not extend the time to pay the tax owed. How do I apply for an extension to file my North Carolina income tax. Nor does it matter that the refund is based on an overpayment of B&O taxes while the assessment involved retail sales taxes, because both taxes relate to the. A business may request a refund due to overpayment of tax. The overpayment may be the result of an amended return, audit or more money paid than was owed.

If you would like to have your overpayment credited to your future Illinois individual income taxes, complete Line Note: You can split your overpayment to. Select Individual Income Tax Payment to get started. Your payment on MyDORWAY automatically submits your filing extension request. Do not mail a paper copy of. extension of time granted the taxpayer; and [PL , c. 1, Pt. EE, §3 (AMD); PL , c. 1, Pt. EE, §4 (AFF).] B. A tax that is paid by the taxpayer before. 4 years after the date of a timely filed return, if filed within the extension period. You can file a claim for refund for a tax year where unresolved tax. If you overpay your taxes, the IRS will simply return the excess to you as a refund. Generally, it takes about three weeks for the IRS to process and issue. Have I Overpaid My Sales/Use/Employer Withholding Tax Account? Payment extension of time to file your Missouri income tax return. Attach a copy of. If you choose to apply part or all of your overpayment to your estimated tax for , the return must be filed by December 31, If I cannot file my return or pay the tax on time, can I request an extension? No If you overpaid your taxes, see Sales Tax Refunds. For additional. Submitting with the tax return a copy of federal Form , Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and. filing the report for the tax period, determined without regard to any extension of time for filing. (2) Any amount overpaid as estimated tax for the tax. How Much IRS Overpayment Can Be Applied to Next Year? You can choose to apply all or just some of your IRS overpayment to next year's taxes. If you use the. No paper or electronic extension form needs to be filed to obtain the automatic filing extension. An extension does not allow an extension of time to pay the. Overpayments for that exist as of April 15, (because payments made on or before April 15, , exceed the tax liability) will be applied as of. Expanded instructions for Line Amount You Overpaid in the tax year's federal income tax form Extension Requests · Farmers and Commercial. For calendar year taxpayers, the extended due date is September 15, When will the update to the election process be available in My Alabama Taxes? Claim the total amount of the extension payment on your Michigan Individual Income Tax return. This amount will be included when calculating the amount you owe. If you believe you have overpaid your taxes, you may file for a refund through Quick Tax or by mail. Be sure to include all income information and any. If an amended return is filed to have an overpayment of Connecticut Pass‑Through Entity Tax (PE Tax) refunded, the overpayment will be refunded to the PE. Extension for Filing Individual Income Tax Return · Individual Estimated Refund of Overpaid Tax; Request for Departmental Review; Final Determination. Individual Income Tax Filers: If you have an approved federal extension and do not expect to owe additional income tax, or if you.

Best Homeowners Insurance Companies In Michigan

#1 · lemonade insurance reviews and ratings - company logo. Lemonade Insurance Company. · reviews ; #2 · USAA Insurance logo. USAA. · reviews ; #3. Best High Net Worth Insurance Company. Private Asset Management Awards: Average annual savings on homeowners insurance for members nationwide. Best Homeowners Insurance Companies in Michigan · Amica · USAA · State Farm · Allstate · The Hanover. Best for high-value homes. The Hanover specializes in. AAA Insurance, Nationwide, Progressive, Encompass, Safeco, Liberty Mutual, Travelers, State Auto, National General, Grange, Foremost, as well as general. Farm Bureau Insurance's mobile homeowners policy gives you standard home coverage, while keeping you protected from risks exclusive to factory-built homes. Michigan Insurance Company, Donegal Mutual Insurance Company, Atlantic States Insurance Company, and Peninsula Insurance Company are property and casualty. Find the best coverage for you with Progressive's HomeQuote Explorer® tool. It allows you to easily compare rates and coverages on homeowners insurance in. Listen up Michigan; home insurance doesn't have to be so difficult. We take the hassle out of home insurance and will get you the best coverage today. ✓ Within the past 5 years you have been denied payment by an insurer of a claim under a home insurance policy based on evidence of arson, fraud, or conspiracy. #1 · lemonade insurance reviews and ratings - company logo. Lemonade Insurance Company. · reviews ; #2 · USAA Insurance logo. USAA. · reviews ; #3. Best High Net Worth Insurance Company. Private Asset Management Awards: Average annual savings on homeowners insurance for members nationwide. Best Homeowners Insurance Companies in Michigan · Amica · USAA · State Farm · Allstate · The Hanover. Best for high-value homes. The Hanover specializes in. AAA Insurance, Nationwide, Progressive, Encompass, Safeco, Liberty Mutual, Travelers, State Auto, National General, Grange, Foremost, as well as general. Farm Bureau Insurance's mobile homeowners policy gives you standard home coverage, while keeping you protected from risks exclusive to factory-built homes. Michigan Insurance Company, Donegal Mutual Insurance Company, Atlantic States Insurance Company, and Peninsula Insurance Company are property and casualty. Find the best coverage for you with Progressive's HomeQuote Explorer® tool. It allows you to easily compare rates and coverages on homeowners insurance in. Listen up Michigan; home insurance doesn't have to be so difficult. We take the hassle out of home insurance and will get you the best coverage today. ✓ Within the past 5 years you have been denied payment by an insurer of a claim under a home insurance policy based on evidence of arson, fraud, or conspiracy.

Westfield and Erie are the best home insurance companies based on rates, customer complaints, discounts and coverage offerings. Progressive and Nationwide. Why Agency height? Local Coverage Expertise. Explore top agents who best understand your location, local laws, and needs. The Power to Choose. Talk to an. Find top-rated home insurance from national carriers at affordable prices. Let InsureOne agents provide excellent customer service and flexible plans tailored. Homeowners Policy Comparison ; Foremost Insurance Company Grand Rapids, Michigan ; Dwelling Fire Three Policy Owner Occupied (PDF) ; Tenant Insurance Policy (PDF). Liberty Mutual understands the needs of Michigan homeowners and offers customized homeowners insurance coverage to fit your specific situation. You're minutes away from the best coverage for your home, car and more. Get We've got the best of the best insurance companies working for you. Find top-rated home insurance from national carriers at affordable prices. Let InsureOne agents provide excellent customer service and flexible plans tailored. As a State of Michigan employee, you now have access to auto and home insurance coverage available to you from two leading insurance providers. help needed: Michigan home insurance comparison · State farm list deductible as 1% of coverage A. · Allstate Endorsements: Roof surface extended. Get a free Michigan homeowners insurance quote today. Nationwide offers a variety of home insurance coverage options to protect your home and property. We help customers realize their hopes and dreams by providing the best © Allstate Insurance Company. ¹Features are optional and a part of the. Best Homeowners Insurance Agencies in Michigan · Our Recommended Top 13 · Providers · Blackmore Rowe Insurance · E&Y Agency, LLC · Bois Insurance · Aspen Insurance. Top 5 Best Home Insurance Companies for · AAA · ASI · FOREMOST · PROGRESSIVE · SAFECO. Safeco was founded in Seattle, Washington in and offers home. The ideal Michigan homeowners insurance protects your property from such dangers as fire and harsh weather. Get a quote online from VIU by HUB today! Get Michigan homeowner insurance quotes for maksakovadynasty.rue top homeowner insurance companies in MI and find the most affordable policy that is right for you. AAA and Frankenmuth have some of the cheapest homeowners insurance premiums in Michigan, but rates may vary depending on the policyholder. Those who struggle to. Best High Net Worth Insurance Company. Private Asset Management Awards: Average annual savings on homeowners insurance for members nationwide. Homeowners Policy Comparison ; Foremost Insurance Company Grand Rapids, Michigan ; Dwelling Fire Three Policy Owner Occupied (PDF) ; Tenant Insurance Policy (PDF). Detroit Homeowners Insurance Reviews ; State Farm ; Being the nation's largest homeowners insurance provider has it perks, which include offering some of the. The price of a typical homeowners insurance policy in the U.S. rose about 10 percent in , according to the Insurance Information Institute, an industry.

Easy Home Improvement Loans

There are home repair loans available through Fannie Mae, the FHA, HUD, the USDA, and the VA. Government loan programs are great options for individuals who may. Cover the cost of your home improvement project, big or small. · Home equity line of credit (HELOC) · Home equity loan · Cash-out refinance · Home improvement. When it comes to home improvement loans, minimum credit score requirements are mostly determined by the lender and the loan type. Learn More About No Credit. Finance your home improvement project with an unsecured personal loan from PNC. Borrow Home Improvement Loans. Renovate redecorate & refresh. Make it easy. With a home improvement loan, you could cover repair and renovation expenses with ease. No impact to your credit score if you are not approved! + I have an. A home improvement loan is a personal loan used to pay for home repairs or renovation projects. SoFi's home improvement loans range from $5K-$K and they're. Apply for a home improvement loan online in 3 steps ; Get your rate. It takes less than 5 minutes to check your rate—and it won't affect your credit score.¹. Find the perfect home improvement loan: · Get the cash you need by refinancing your existing mortgage · Tap into your home's equity with a Home Equity Loan or. Best for borrowing larger amounts: LightStream Personal Loans · Best for borrowing smaller amounts: PenFed Personal Loans · Best for lower credit scores: Upstart. There are home repair loans available through Fannie Mae, the FHA, HUD, the USDA, and the VA. Government loan programs are great options for individuals who may. Cover the cost of your home improvement project, big or small. · Home equity line of credit (HELOC) · Home equity loan · Cash-out refinance · Home improvement. When it comes to home improvement loans, minimum credit score requirements are mostly determined by the lender and the loan type. Learn More About No Credit. Finance your home improvement project with an unsecured personal loan from PNC. Borrow Home Improvement Loans. Renovate redecorate & refresh. Make it easy. With a home improvement loan, you could cover repair and renovation expenses with ease. No impact to your credit score if you are not approved! + I have an. A home improvement loan is a personal loan used to pay for home repairs or renovation projects. SoFi's home improvement loans range from $5K-$K and they're. Apply for a home improvement loan online in 3 steps ; Get your rate. It takes less than 5 minutes to check your rate—and it won't affect your credit score.¹. Find the perfect home improvement loan: · Get the cash you need by refinancing your existing mortgage · Tap into your home's equity with a Home Equity Loan or. Best for borrowing larger amounts: LightStream Personal Loans · Best for borrowing smaller amounts: PenFed Personal Loans · Best for lower credit scores: Upstart.

Government Loans such as a HUD Title 1 Property Improvement Loan or an FHA k Home Renovation Loan may also be an option. Review the current rates for the. A home improvement loan is a personal loan used to renovate, remodel, or improve your home. Home improvement loans can be used for minor or major projects. A home improvement personal loan lets you improve your house and pay for it over time. This financing option helps cover expenses for any upgrade, repair or. Must be used for a home improvement project · A good option if you don't have sufficient equity in your home · Available as a secured or unsecured loan · Fixed. Property Improvement Loan will pay for materials and labor. · Get more than one estimate. Remember the cheapest one isn't always the best fit. · Read and. Less than you might think. A home improvement loan is often easier to get than a home equity loan. You can get an unsecured loan up to $25,, loan terms up to. Getting a home improvement loan through Avant is a simple, 3-step process. Exploring your rate options won't affect your credit score and if you qualify our. If you're living in an older home that is now too small, needs repairs, remodeling or upgrades, PrimeLending home remodeling loans are a type of refinancing. A home improvement loan is a personal loan to pay for repairs, appliances, remodels, and more. Get up to $ with no origination fee, from Discover. The great thing about a home improvement loan through HFS is that you these are personal loans, so no equity and no appraisal are required or utilized. What. Home improvement loans made easy · Home improvement loans up to $50, · Get your funds as soon as 1 business day · No prepayment penalties. Low rates. Great service. That's Lending Uncomplicated. Whole-project funding, with no fees, no home equity requirements. The unsecured LightStream loan has. 1 Loans also have several repayment terms and allow you to borrow up to $, SoFi is our top pick due to its easy application process, lack of fees. Whether you're remodeling your kitchen, replacing your roof, or just refurnishing your home, a home improvement loan can help. Find your loan at maksakovadynasty.ru! How to get a home improvement loan online with Credible · 1. One simple form. We'll ask questions to narrow down your lender and rate eligibility. · 2. Compare. Take the stress out of financing home improvements. Simple home improvement financing solutions make it easy for your customers to pay over time, while you get. WalletHub makes it easy to find the best home improvement loan rates. Home improvement loans are personal loans that homeowners can use to pay for projects such. Quickly unlock funds for remodeling, repairs, additions and other home improvement projects. Fast, easy application with low origination fees. Upgrade your home—with no collateral required! From small projects to full-scale renovations, we make it easy to get the funds you need fast. With. A home improvement personal loan is an unsecured (no collateral) fixed-rate personal loan that is used for home renovations and repairs and repaid over a.

Best Saving Offers

We compared 73 online savings accounts offered by 53 nationally available banks and credit unions to find the best 5% interest savings accounts. High-Interest Savings Accounts from Discover Bank, Member FDIC offer high yield interest rates with no monthly balance requirements or monthly fees. The best high-yield savings accounts offer % APY from BrioDirect High Yield Savings Account and % APY from Ivy Bank High-Yield Savings Account. Regular savers open to all – what we'd go for. Principality BS offers the top rate overall at 8% fixed for six months on up to £/month. You don't have to. Generally, savings accounts offer flexibility that can be ideal for building an emergency fund, saving As of June , the best savings rates ranged from. Get up to %†† interest with our GICs. Ours come with some of the best rates around. So, whatever your goals may be, it's another great way to save. Evergreen Bank offers a generous % APY on its high-yield savings account, with a minimum deposit requirement of $ With no monthly fees and no minimum. Learn about the benefits of a Chase savings account online. Compare Chase savings accounts and select the one that best suits your needs. U.S. News' picks for the best high-interest-rate savings accounts with low minimums. The national average annual percentage yield for savings accounts is %. We compared 73 online savings accounts offered by 53 nationally available banks and credit unions to find the best 5% interest savings accounts. High-Interest Savings Accounts from Discover Bank, Member FDIC offer high yield interest rates with no monthly balance requirements or monthly fees. The best high-yield savings accounts offer % APY from BrioDirect High Yield Savings Account and % APY from Ivy Bank High-Yield Savings Account. Regular savers open to all – what we'd go for. Principality BS offers the top rate overall at 8% fixed for six months on up to £/month. You don't have to. Generally, savings accounts offer flexibility that can be ideal for building an emergency fund, saving As of June , the best savings rates ranged from. Get up to %†† interest with our GICs. Ours come with some of the best rates around. So, whatever your goals may be, it's another great way to save. Evergreen Bank offers a generous % APY on its high-yield savings account, with a minimum deposit requirement of $ With no monthly fees and no minimum. Learn about the benefits of a Chase savings account online. Compare Chase savings accounts and select the one that best suits your needs. U.S. News' picks for the best high-interest-rate savings accounts with low minimums. The national average annual percentage yield for savings accounts is %.

American Express savings accounts offer competitive savings rates, no monthly fees, & no minimum balance. Apply for a high yield savings account to earn. Sallie Mae named one of the best savings accounts, money market accounts and CDs for Beware of Debt Relief Offers · Contact Us; Website feedback; FAQ. CDs may be a good choice if you have some money in savings that you're unlikely to need right away. They offer a higher interest rate than a traditional savings. Learn about the benefits of a Chase savings account online. Compare Chase savings accounts and select the one that best suits your needs. Best for earning a high APY: Western Alliance Bank High-Yield Savings Account · Best for account features: LendingClub LevelUp Savings · Best for no minimum. We're breaking down some of the best high-yield savings accounts so you can find the perfect place to grow your cash. If you're looking for the best rate for your savings, high-yield savings accounts typically offer yields that pay many times the national average. Best High-Yield Online Savings Accounts of August Many banks now offer high-yield savings accounts with rates above %. That's far above the average. When considering which bank account to go for, think about features you want your account to offer. Some accounts will pay interest on your balance, some will. Whether you want an easy access savings account or a fixed rate account, we've got great deals from a wide range of providers. Today's best high-yield savings account offer rates of 5% APY and above. See which banks are offering the highest rates today. Capital One Bank's Performance Savings Account sports a great % APY (as of 4/11/24), which ranks among the highest rates in the market. With this accoun. See when you might have the best chance to get a good deal and learn how timing can impact your decision making. Support. Stay Informed on News and Issues. Evergreen Bank offers a generous % APY on its high-yield savings account, with a minimum deposit requirement of $ With no monthly fees and no minimum. Find the top interest rate savings accounts & maximise your returns with Martin Lewis' guide. Includes the top easy access and fixed-rate accounts to help. The best high-yield savings accounts will have a strong interest rate, good perks, and national accessibility. The top options also offer no monthly. Our best offer ever on home loans. Don't miss this limited time offer! Get a Invite Friends. Help a friend bank smarter with little to no fees, high savings. Use savings buckets to organize your money and visualize what you're saving for The interests rates are the best I've seen and my savings has grown more. Cash back deals. Want to put more in savings? Search participating merchants and earn up to 10% cash back on everyday purchases. Raisin exclusively offers higher-earning savings Once again, the best savings account interest rates can vary and fluctuate based on several factors.

1 2 3 4 5